Which is the right insurance plan to cover cancer treatment expenses?

While millions of humans all round live with this fact, no person ever wants to hear the phrase most cancers. Treatment fees have exploded as scientific information raises survival quotes. Among the shockingly steeply-priced cancer treatments now provided are superior drugs, radiation, chemotherapy, and surgery. This is based on having the proper insurance insurance to accurately manipulate cancer treatment charges.

On this weblog, we will intently study in fantastic element the several coverage options for cancer treatment, factors to be taken into consideration whilst selecting the great one, and the way these plans might assist to reduce the economic load in the course of this type of worrying duration.

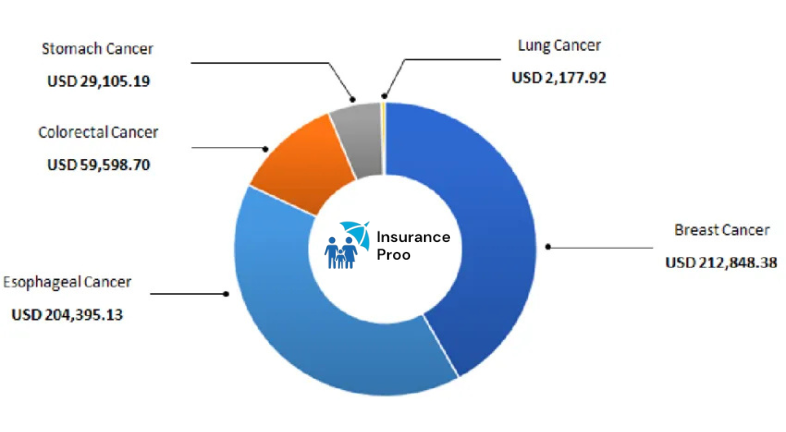

Understanding Cancer Treatment Costs:

An knowledge of the causes of the steeply-priced nature of most cancers treatment will facilitate the assessment of to be had coverage answers. The value of cancer remedy can be determined by using the sort of most cancers, the progression of the disorder, and the period of the remedy. The number one reasons of the determined charges in most cancers treatment are as follows:

- Diagnosis and Testing: The fee of ordinary scans, biopsies, and advanced diagnostic checks, inclusive of CT scans or MRIs, is vast.

- Treatment: Often ensuing in great fees are chemotherapy, radiation therapy, centered treatment, immunotherapy, and surgical procedures.

- Hospitalization: Many cancer patients have to make long visits to both hospitals or specialized cancer clinics.

- Post-Treatment Care:Rehabilitation, medications, and follow-up appointments incorporate ongoing expenses that stand up subsequent to the number one remedy section.

- Supportive Care: In addition, palliative care, physical therapy and counseling may be needed to enhance the exceptionality of the affected person’s life.

It is essential to have insurance coverage this is sufficient to cover the prices of cancer treatment, as those charges can quickly collect to millions.

Types of Insurance Plans for Cancer Treatment

Cancer treatment is expensive, hence different kinds of insurance plans can be availed to cater for the treatment costs. However, the appropriate one will differ based on one’s condition, for instance health, family history, and the ability to pay. Here are the key ones to be addressed:

1. Comprehensive Health Insurance Plans

These programs normally on the side of maximum most cancers for diverse illnesses Although now not maximum cancers these days, they provide economic safety toward surgical techniques, medical institution remains and severa clinical expenses related to most cancers.

- Pros: In addition to most cancers, this policy safeguards you from lots of clinical situations.

- Cons: They regularly impose sub-limits on most cancers remedy, which could result in a partial or general lack of coverage for all charges.

Examining your current complete medical health insurance coverage for any cancer-related exclusions or restrictions is one sensible idea. Some all-encompassing rules may also just cowl steeply-priced treatments like chemotherapy very sparingly.

2. Critical Illness Insurance Plans

Critical illness insurance is specifically designed to cover life-threatening illnesses, including cancer. Upon diagnosis of cancer, the insurance company pays the policyholder a lump sum which can be used for medical treatment, recovery after care or even daily living expenses.

- Pros: Pays one charge upon cancer prognosis, so supporting within the manipulate of treatment prices.

- Cons: Best after a crucial infection prognosis has been made. In the occasion that the insured survives and develops additional ailments, they may not be protected.

Though some plans won’t cowl early-degree cancers, commonly vital contamination plans cover all sorts of cancer. Before selecting this plan, kindly make certain you understand the insurance and exclusions.

3. Cancer-Specific Insurance Plans

As their identify indicates, these applications are solely designed for cancer remedy. Their payouts are indicative of the different stages of most cancers, consisting of early, main, and important ranges, relying on the severity of their analysis. Associated prices, together with radiation, chemotherapy, and operations, also are covered with the aid of positive regulations.

- Pros: Designed in particular for cancer sufferers, this coverage gives entire insurance of all remedy stages and better payouts.

- Cons: There is no prevention of other diseases or fitness issues; it exclusively addresses most cancers.

For the ones who’ve a family history of most cancers or are mainly involved about this disorder, most cancers-specific plans are the most suitable alternative. They assure monetary balance all through the cancer journey through imparting complete insurance from prognosis to superior remedies.

4. Top-Up Health Insurance Plans

If you have fundamental medical insurance, a pinnacle-up plan could deliver extra insurance for cancer treatment. These plans will begin to paintings while your present insurance coverage restriction expires. For the management of expensive remedies, such most cancers, this could be helpful since it gives higher insured amounts at rather inexpensive costs.

- Pros: Presents supplementary insurance similarly to the limits of a modern-day medical insurance policy and preferential coverage for expensive approaches.

- Cons: It will simplest come to be energetic at that factor, accordingly you may ought to pay out-of-pocket till your base insurance policy runs out.

A possible opportunity is to purchase pinnacle-up plans if you want to improve your current insurance without purchasing a separate most cancers-precise plan.

Factors to Consider When Choosing the Right Insurance Plan

Choosing the right coverage for most cancer treatments requires careful consideration of many important factors. Items evaluated include:

- Coverage for Different Cancer Stages

The plan should embody all tiers of cancer, from early prognosis to superior bureaucracy. Early detection is critical for your protection, as certain coverage policies may additionally simplest provide coverage for later-stage tumors.

- Waiting Periods

Most insurance policies consist of a waiting period – that is, the amount of time that must elapse after coverage is purchased before coverage is offered. If your family history or manner of existence increases your cancer hazard, then pursue plans with shorter ready durations.

- Sub-Limits and Co-Payments

Co-payments force you to pay a number of the remedy prices out-of-pocket; sub-limits are caps positioned on the diploma the coverage will cover for precise remedies. To help you to lessen your financial load, search for plans with smaller co-bills and much less sub-limits.

- Pre-Existing Conditions

Inquire as to whether or not the plan affords insurance for previous scientific situations if you are diagnosed with cancer or any other infection. Certain regulations may not provide coverage for diseases that were gift prior to the purchase of the coverage.

- Premiums vs. Benefits

The premium charges ought to be balanced through the advantages of the scheme. While a low-top class plan may also appear attractive, it would now not provide sufficient coverage for cancer remedy. In assessment, a excessive-premium policy might be financially hard if it isn’t necessary.

- Cashless Treatment Options

Many times, coverage businesses offer cashless treatment—that is, the insurer without delay paying the health facility’s medical payments. For luxurious remedies like most cancers, this is in particular helpful because it lessens the anxiety occasionally related with the manner first bills are organized.

Conclusion

In order to determine the most appropriate coverage plan for cancer remedy, it’s far important to conduct a complete assessment of a selection of things, inclusive of the form of insurance, the extent of insurance for numerous cancer tiers, and the economic benefits. Each insurance policy has its personal blessings and disadvantages, whether it is miles or not, it is a policy that is unique to most cancer, comprehensive health insurance plan or vital contamination insurance. Your personal desires, tolerance for chance, and financial goals define the best plan in the final analysis. A most cancers insurance plan can supply your own family and your self monetary protection throughout an already difficult time and peace of thoughts need to an impossible occasion arise.

While most cancers can be bodily and emotionally demanding, with appropriate insurance you can consciousness on recuperation free from monetary issues approximately treatment price. Review your insurance decisions regularly; exchange as wished; supply your fitness and future security first interest.