Why health insurance with OPD covers are growing popular in India?

While health insurance has always constituted one core aspect of primary health care trust in India, there is another recent situation which occur more often: policies that offer full reimbursement of outpatient department (OPD) treatment costs are increasingly on the rise. Possessing health insurance policy in India has always focused more on covering disease treated and admitted within hospitals rather than outside. Therefore, there has been a wide scope of outpatient care which includes all treatment services such as consultations, investigations, and even day surgeries where the patient is not admitted. Many people managed to access quality health care however due to this inequity, they had to incur expenses from their own pockets. It would also be understood that there tills are mass appeal, for both urban and rural populations, the tans own stretch of hospitals coverage. A better perspective is provided below on the reasons as to why over the last decade in India health insurance policies have made OPD cover compulsory to their aforementioned sections as well as the reasons behind the phenomenon.

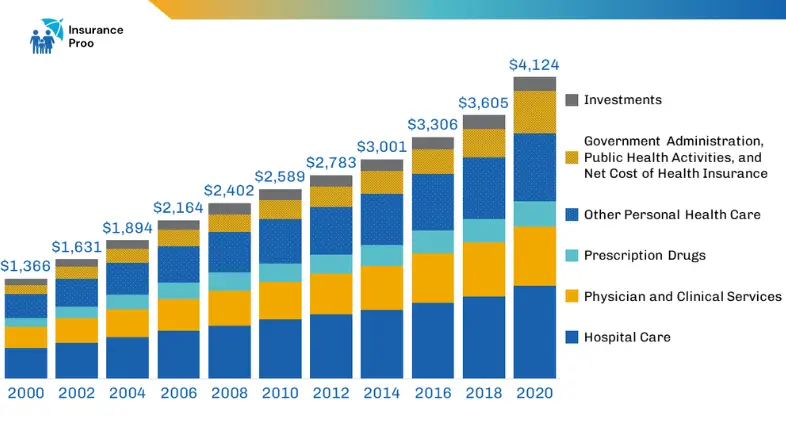

1. Increasing Healthcare Costs

Over the last decade, there has been an explosion in the rates of consultations, diagnostics, and preventative treatment in India. Typically, the average person makes a sensible effort to pay a substantial amount of money towards their medical expenses in the out-patient operations (OPDs). Over time, families with small babies or older members tend to incur more out-of-pocket costs due to several hospital visits. OPD facilitates the provision of these outpatient fees; thus, families can now access health insurance cover for both inpatient (hospitalization) and outpatient services thus enabling better management of these costs, which are on the increase.

2. Shift in Health Insurance Awareness

The COVID-19 pandemic has led to an upsurge in the health awareness of the Indian population. It is observed that people are beginning to appreciate the benefits of preventive healthcare, services which are mostly outpatient, and have tended to institutionalize regular check-ups. The public with the support of their governments as well as insurance companies has been sensitized on the need of having health insurance covers that are not related to the hospitalization of an individual. Hence people and households do tend to find such policies that cover OPD treatment more often because they consider it a basic pillar of support for complete healthcare.

3. Increased Incidence of Lifestyle Diseases

The number of lifestyle-related illnesses, for instance hypertension, diabetes, and heart disease has increased significantly due to the increased inactivity and consumption of processed food. Managing such chronic illnesses requires regular outpatient procedures involving constant check-ups, several doctor visits, and numerous diagnostic tests, which are usually done under outpatient treatment. OPD-covered health insurance coverage can help consider the expenses required to pay for such recurrent visits, and most importantly, treatment of their conditions will be based on preventative medicine. Accordingly, the insurers have responded by offering a greater number of policies that provide for OPD facilities, which is being taken up by an ever-increasing number of people who appreciate the benefits of available services for a sustained period.

4. Flexible Coverage for Minor Treatments

A significant proportion of health problems can be addressed through minor remedies or consultations and procedures that do not require hospital admission. Such outpatient procedures as dental care, physiotherapy, and basic medical check-ups are often excluded from conventional insurance policies. OPD coverage encourages policyholders to go for such treatments without the fear of excessive out of pocket expenses. The notion of preventive health is also strengthened by the all-inclusive OPD cover in India, which allows people to seek treatment for mild ailments rather than waiting for them to degenerate.

5. Addressing the Lack of Savings for Medical Emergencies

A significant number of families in India continue to dip into their savings in order to seek medical assistance. Most of the associated costs incurred during hospitalization are borne by the patient especially for outpatient care, which however tends to become more expensive with time.There are means through which persons can shield their assets, in this case by employing health insurance for more regular visits to hospitals’ outpatient departments. OPD is working on this issue at present. This has been recognized by paid individuals who have come to appreciate the fact that families need to know that any medical costs they incur no matter how high will not side-track them financially.

6. Catering to the Needs of the Self-Employed and Small Business Owners

Most of the workers in the country are self-employed, small business owners or contractors, and people who do not enjoy consistent employer-sponsored health cover. For this sector, OPD coverage is more attractive as it usually caters for daily healthcare expenses that are usually self-financed. Since it offers one the hope of being able to afford quality care that one is otherwise unable to do without the provision of such services, health insurance with OPD cover, in this case, becomes more interesting to this group.

7. Enhanced Tax Benefits

In India, people can lower their taxable income by the health insurance premiums benefits available under Section 80D of the Income Tax Act. In addition to improving healthcare protection, OPD insurance also helps the individual cut down expenses on taxes even further which as a result serves as an additional motivation for the individual. This comes as a huge benefit to a number of policyholders, even those who would not ordinarily be interested in health insurance, the appeal of OPD-based cover inclusive of tax breaks.

8. Customization and Flexibility from Insurers

Insurance firms are also providing more flexible, tailored plans covering OPD in line with the specific needs of their clients. Since policyholders may define the type and level of OPD coverage they require, these tailored plans offer a customized health insurance solution. OPD insurance had been rather popular since people may now choose the specific advantages they need without paying for useless ones.

9. Young Generation’s Changing Health Priorities

Unlike older generations, Millennials and Generation Z are perfect health enthusiasts who prefer preventative treatment, general wellness and frequent visits. The younger lot believes in the proactive management of one’s health by regular checkups and seeking advice unlike before. They also seek for medical covers that support all these healthy ideals. The progressive and healthwise attitude of the health seeking younger populace has been the leading factor for the proliferation of health insurance cover providing outpatient department services and hence, the availability and the cost increased.

10. Digitalization and Accessibility of Healthcare

There has been a remarkable improvement in the accessibility of outpatient services with the digital transformation of healthcare. At present, many health insurance companies include options for telemedicine services within the ambulatory care insurance policies. This allows customers to order medicines, book lab tests and communicate with physicians staying at home. This development has been deftly managed by insurance firms offering OPD inclusive covers, which has been able to popularize OPD insurance remarkably and also give a wonderful experience. The ease of accessing OPD facilities has also been one of the strong reasons for policy holders looking for such policies in metro cities of India, where telehealth is booming.

Conclusion

In India, health insurance policies are taken out more frequently for reasons including rising costs, evolving healthcare needs for the nation, and a shift in preference for preventive care. Treatment regimes at attending a hospital and the expenses incurred on day-to-day care are bridged in the OPD coverage which makes use of the availment of medical care more accessible and affordable and also makes it preventive in nature. Given the demand from the insures to provide more comprehensive solutions and the government’s encouragement, it is expected that there will be an upward trend in the inclusion of OPD benefits in health insurance plans. In India, this represents a shift in the healthcare paradigm as the objective is designed to build a comprehensive system of health management so that it is possible to live a quality life without the risk of diseases rearing their head.

Read more :- Rising Costs of Health Insurance Premiums in 2024