How to review your insurance policy annually

Here’s an article to provide a thorough and up-to-date guide on how to review your insurance portfolio annually while incorporating the most relevant and frequently used keywords in the insurance domain, for instance, insurance, coverage, policy, premiums, claims, risks, benefits & financial planning. Below are these detailed step-by-step processes customised to help you ensure your insurance portfolio aligns with your current needs and financial goals. The information draws from recent insights, which are found across web sources, and also builds on the initial responses for more thorough investigations as well.

Why Reviewing Your Insurance Portfolio Annually is Essential

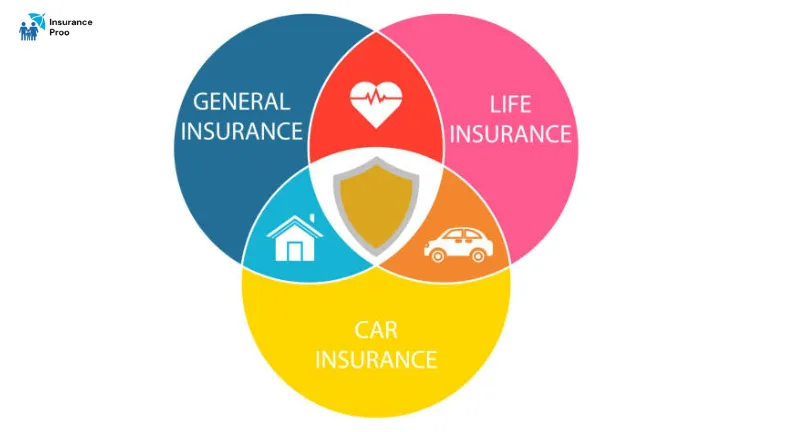

An insurance portfolio is a collection of your insurance policies, which includes life insurance, health insurance, auto insurance, homeowners’ or renters insurance, and also specialized coverages like disability insurance or umbrella insurance. Regularly reviewing these portfolios to ensure that your coverage remains adequate, cost effectiveness& aligned with your evolving financial planning goals. Life events, economic changes, and new risks can make your existing policies outdated, which can potentially leave you underinsured or overpaying for unnecessary premiums. An annual review of thèse risks protects your assets and also provides financial security for you and your family.

These processes which involves gathering policy details, assessing life changes, evaluating coverage adequacy, reviewing premiums, checking claim processes also planning for future needs. By incorporating these high frequency keywords and also leveraging awareness from sources. In this guide which offers structured approaches to optimize your insurance portfolios too.

Step 1: Gather Insurance Policies all in one place

Start by assembling all your insurance policies in one place. It includes:

- Life insurance: Term, whole, or universal policies that provide death benefits to beneficiaries.

- Health Insurance: Plans covering medical expenditures, which include employer-provided or individual policies.

- Auto Insurance: Coverage for vehicles, including liability, collision, and comprehensive plans.

- Homeowners or renters’ insurance: It’s protection for property, personal belongings, and liability.

- Specialized policies: Disability insurance, long-term care insurance, or umbrella insurance for additional liability coverages.

Organizing documents by policy types, insurer, premium amounts, renewal dates and also beneficiary details. Using spreadsheets or digital tools in order to track policy numbers, coverage limits, and riders (add ons for specific risks). This step as highlighted by which provides foundation for understanding your coverage landscapes and also identifying overlaps or gaps.

Step 2: Assess Life changes and Risk exposures

These insurance needs evolve with life events. Reflects on these changes over the past years:

- Personal milestones : Marriage, divorce, childbirth or loved one’s passing which may affects your life insurance or health insurance needs. For eg., new child may requires increasing your life insurance coverages to secure their education or living expenses too.

- Financial changes: Job promotions, job loss or new investments which may necessitate adjustments to your insurance portfolios. Increased income might warrants higher life insurances in order to maintain your family’s lifestyle too .

- Asset growth: Purchasing homes or cars may increases your risk exposure while requiring updates to homeowners insurance or auto insurance. For eg.,buying a home may calls for mortgage protection insurance in order to cover loan payments in case of deaths.

Evaluate your risk profile. If you’ve moved to a flood prone areas then considers adding flood insurance since standard homeowners insurance often excludes such risks. Similarly, if you’ve started a business then you may need business insurance to cover equipments or liability. In these steps which ensures portfolios addresses current including emerging risks too.

Step 3: Evaluates coverage adequacy

Assess whether each policy provides sufficient coverage for our needs:

- Life insurance : Calculating whether these death benefits covers these major expenditures for eg. mortgages, education costs or living expenditures for beneficiaries too. Online calculators can estimates your human life value (HLV) while factoring in these liabilities and future goals. It suggests reducing these life insurance as assets grow with age yet increasing with new liabilities like home loans.

- Health insurance: Verifying that your plans cover preventive care, hospitalization, including prescription drugs. Check deductibles and co-pays to ensure affordability. If you’ve developed health conditions, then consult your doctor to ensure adequate coverage as advised. – Auto insurance: It ensures liability, collision, and thorough coverages match your vehicle’s values and driving habits. If you’ve upgraded your car, then adjust your policy accordingly.

- Homeowners or renters’ insurance: It confirms that coverage limits reflect the replacement costs of your home or belongings. Consider add-ons like flood insurance or earthquake insurance in high-risk areas, since it emphasizes that standard policies often exclude these.

Just compare these coverage limits to your current assets and liabilities. Underinsurance can expose you to financial risks, while overinsurance may increase premiums unnecessarily.

Step 4: Review Premiums and Costs

Premiums are key components of your insurance portfolios. Evaluating whether you are getting value for your money:

- Affordability: Comparing these remium costs to fit into your BubudgetIf they’re struggling your finances then explore cost saving options without sacrificing coverages.

- Discounts: Many insurers offer discounts for bundling auto and home insurance then maintaining good driving records, or installing safety features like home security systems. Vista insurance.co.uk suggested analyzing premium rates in order to identify savings opportunities too.

- Rate changes: Contact insurers to understand any premium increases. Shop around these insurance quotes from other providers to ensure these competitive prices.

Using online comparison tools or consulting an insurance agent to find cost-effective options. These steps balance financial planning with adequate coverages.

Step 5: Checking claims Process and Insurer Reliability too

Reliable claims processes are critical when one needs to use their insurance. Assess your insurer’sperformances:

- Claims history: Reviewing our experiences filing claims. Researching customer reviews or ratings ( For e.g., J.D. Power, AM Best) to evaluate our insurer’s claims handling. Bancorp insurance.com stresses the importance of efficient claims processing too.

- Customer service: Testimg your insurer’s responsiveness by contacting them with questions.Reliable insurers which provides clears communication and support too.

- Financial stability: Checking the insurer’s financial strengths through agencies like AM Best or standard & poor’s in order to ensure they can pay claims on time too.

If these insurers has poor track records then consider switching to providers with better claims handling and financial stability while suggested by self empowered financing.com.

Step 6: Updating Beneficiaries and Policy Details

It ensures your policy details are current, especially for life insurance:

- Beneficiaries: Just verify that listed beneficiaries are reflect into your current wishes. Life events for instance marriages or divorces which may require updates as noted by coversure.in.

- Personal information: Updating your addresses, contact details, or marital statuses with your insurers.

- Policy terms: Review these changes in policy terms, for eg, exclusions or limitations in order to avoid surprises during claims.

Failure to update these beneficiaries may lead to disputes, so this step is crucial for ensuring benefits in order to reach the intended recipients too.

Step 7: Identifying Gaps includes overlaps in coverage

It analyzes insurance portfolios for gaps else overlaps as follows:

- Coverage gaps: Identifying these unprotected risks. For instance, if you’re doing wfh, then one may need business insurance for equipment or liability, as standard homeowners insurance might not be done on own. Logica Infotech highlightsthee importance of addressing gaps to enhance financial flexibility too.

- Overlaps: Check for duplicate coverages. For instance, rental car damages may be covered by auto insurance, credit cards, or travel insurances as noted by Stanford law school’s CodeX. Just Eliminate these overlaps might reduces unnecessary premiums .

Considering these specialized policies, for eg, umbrella insurances for extra liability protection or long-term care insurances for future healthcare needs. These steps optimize portfolios for thorough coverage at a reasonable cost.

Step 8: Consulting these professionals whenever required

For complex portfolios, one must consult licensed insurance agents or financial advisors, too. They can:

- Offers personalized recommendations based on your risk profiles, also financial goals.

- Clarify complex policy terms and restraints.

- Compare these insurance quotes, including negotiating with insurers.

GoodMoneying.com sites recommend reviewing portfolios with certified Financial Planners every three years or after major life changes. A professional must ensure insurance portfolios with broader financial planning.

Step 9:Plannings for Future Risks

Just looking ahead to expect emerging risks that align insurance portfolios with long-term goals:

- Emerging risks : Considering these new threats like cyberattacks which might requires cyber insurances. WTW which emphasizes that these active portfolios management can address evolving risks using advanced data analytics too.

- Long term goals: Adjusting life insurance or disability insurance to support goals like funding a child’s education or building a retirement entity, as suggested by the site policybazaar.com.

- Policy Renewals: Note that renewal dates and setting reminders are done by reviewing policy terms before automatic renewals.

These Proactive planning which ensure insurance portfolios remain sturdy tools for financial security.

Step 10: Document includes Track Reviews

Document reviews findings include:

- updates or changes in these policies.

- Notes on premiums, coverage limits, and beneficiaries.

- Action items, for eg, obtaining new insurance quotes or contacting your Insurer.

Using digital tools or spreadsheets to track your insurance portfolios and schedule your next annual reviews. It suggests linking reviews to policy renewal dates for consistency too .

Final Conclusions or Verdict after the deeper analysis are as follows are mentioned below

An annual insurance portfolio review is a foundation of effective financial planning. By gathering these olicies, assessing life changes, evaluating coverages, reviewing premiums so addressing gaps so that you ensure your insurance meets your needs. Checking these claims processes, updating beneficiaries also consulting professionals which further enhances your portfolio’s effectiveness. Planning for these future risks also documenting your reviews keeps your financial security intacts.

In this guide informed by DeepSearch insights empowered which incorporates high frequency keywords to provides clear & actionable roadmaps. Regular reviews safeguard your assets , diminish risks also provides peace of mind while ensuring your insurance portfolios remains powerful tools against life’s uncertainties. I hope this helps.

Read more at: Best Life Insurance Policies with cash value in the U.S