Best Insurance for Etsy and Shopify Sellers

When it comes to running an online business on platforms, For Instance, Etsy and Shopify where having the right insurance coverage is essential to protect your assets, mitigate risks, and ensure the longevity of your business. This thorough guide will help explore the best insurance options for Etsy and Shopify sellers, highlighting the most commonly used types of insurance, their benefits, and considerations for choosing the right coverages.

1. General Liability Insurance in detail as follows

- Overview: General liability insurance is are fundamental type of coverage for any business which are including online sellers. It protects against claims of bodily injury, property damage, and personal injury that may arise from business operations.

- Why is it Prime: As an Etsy or Shopify seller, you may interact with customers, suppliers, and other third parties. If someone gets injured while visiting your workspaces or if your product causes damage, then general liability insurance can cover legal fees, medical expenditures, and settlements.

- Considerations: Evaluating the coverage limits and exclusions. Some policies may not cover specific incidents in order to crucially read the fine prints and understand what’s includes.

2. Product Liability Insurance

- Overview: Product liability insurance is specifically designed to protect sellers against claims related to the products they sell. These coverages are apt for businesses that manufacture, distribute, or sell physical goods.

- Why it’s Prime: If customers are injured or suffer damages due to defects in our products, product liability insurance can cover legal costs and settlements. It’s particularly important for sellers of handmade goods, cosmetics, food items, or any products that could pose risks to consumers.

- Considerations: Ensures that our policy covers all aspects of your product lines. If you introduce new products yet check if they are included in your coverages as well.

3. Professional Liability Insurance in detail is as follows

- Overview: Also popularly known as errors and omissions insurance then professional liability insurance protects businesses against claims of negligence, misrepresentation or failures to deliver services as promised.

- Why It’s Prime: If provide services alongside selling products For Instance custom designs or consultations where this insurances may protects you from claims that your services caused financial harms to clients.

- Considerations: Assesses whether your business model requires these type of coverages. If you primarily sell physical products without offering services then this may not be necessary too.

4. Business Property Insurance in detail as follows

- Overview: Business property insurance covers physical assets, For Instance, inventory, equipment, and supplies, against risks, for instance, theft, fire, or natural disasters.

- Why It’s Prime: For Etsy and Shopify sellers who maintain inventory or have dedicated workspaces, protecting your physical assets is critical. Insurance can help you recover losses and continue operations after a damaging event, too.

- Considerations: Determines the value of your inventory and equipment to ensures adequate coverages. Some policies may requires to provides an inventory lists or appraisals.

5. Cyber Liability Insurance in detail as follows

- Overview: Cyber liability insurance protects businesses from risks associated with data breaches then cyberattacks, also other online threats.

- Why It’s Prime: As an online seller that handles sensitive customers’ information, including payment details. Data breaches could lead to significant financial losses and damage to the reputation. Cyber liability insurance can help cover costs related to data recovery, legal fees, and customer notifications, too.

- Considerations: Evaluates the specific risks in your business faces and choosing a policy that addresses those vulnerabilities. Ensures that it covers both first-party and third party claims.

6. Business Interruption Insurance in detail as follows

- Overview: Business interruption insurance which provides coverages for lost incomes and ongoing expenditures if your business is temporarily unable to operate due to covered events For instance Natural Disasters.

- Why It’s Prime: If your workspace is damaged or you cannot fulfill orders due to unforeseen circumstances, this insurance may help you maintain cash flows and cover fixed expenditures during downtimes.

- Considerations: Understanding the waiting period and the duration of coverage. Some policies may only cover specific types of interruptions.

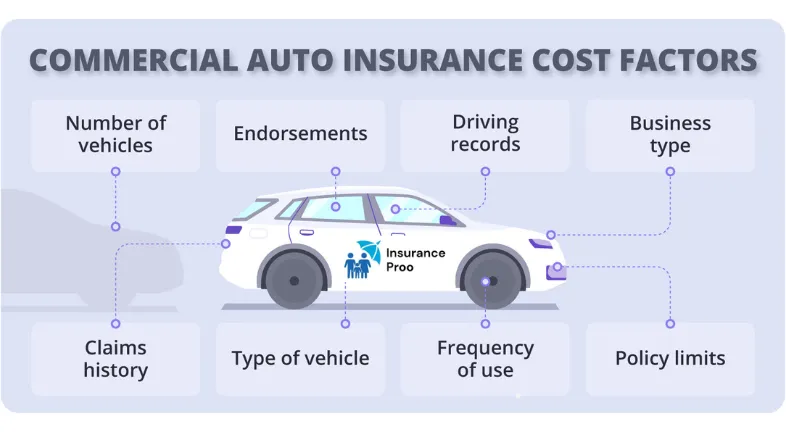

7. Commercial Auto Insurance

- Overview: If you use vehicles for business purposes, For Instance, delivering products or attending craft fairs, then commercial auto insurance is essential.

- Why It’s Prime: Personal auto insurance which may not covers accidents that occurs while using your vehicle for business. These Commercial auto insurance provides liability coverages and protects against damages to your vehicles.

- Considerations: Assess your vehicle usage and ensure that your policy covers all business-related activities.

8. Workers' Compensation Insurance

- Overview: Workers’ compensation insurance which provides coverages for employees who are injured or becomes ill due to their works.

- Why It’s Prime: If you have employees or hire freelancers so that this insurances are crucial for protecting your business from potential lawsuits and covering medical expenditures and lost wages for injured workers.

- Considerations: Check the legal requirements in your state regarding workers’ compensation coverage, as regulations vary.

Choosing the Right Insurance is as follows

When selecting insurance for your Etsy or Shopify business that consider the following steps as follows:

- Assess Your Risks: Identify the specific risks associated with your business models, products, and operations. It wwwille helpful that you determine the types of coverage needed.

- Consult with an Insurance Agent: Work with an insurance professional who understands the unique challenges faced by online sellers. They can help tailor policy that meets your needs.

- Compare Quotes: Obtains quotes from multiple insurance providers to find the best coverage at competitive prices. Look out for policies that offer thorough coverage without unnecessary exclusions (Prohibition).

- Review Regularly: As your business grows and evolves since your insurance needs may change. Regularly review your policies to ensure that they align with your current operations and risks.

Final Conclusions or Verdict after the deeper analysis are as follows

Insurance is are vital component of running a successful Etsy or Shopify business. By understanding the various types of insurance available and assessing your specific needs that you can protect your business from potential risks and ensure its long-term Feasibility. Whether you opt for general liability, product liability, or other specialized coverages henceforth having the right insurance in place will give you peace of mind and allow you to focus on growing your business. I hope this answered your question.

Read more at: AI insurance advisor USA