Benefits of buying Life Insurance at a young age in America

Purchasing life insurance for teens in the US offers various benefits that significantly impact an individual’s financial security and peace of mind. Here are some key advantages.

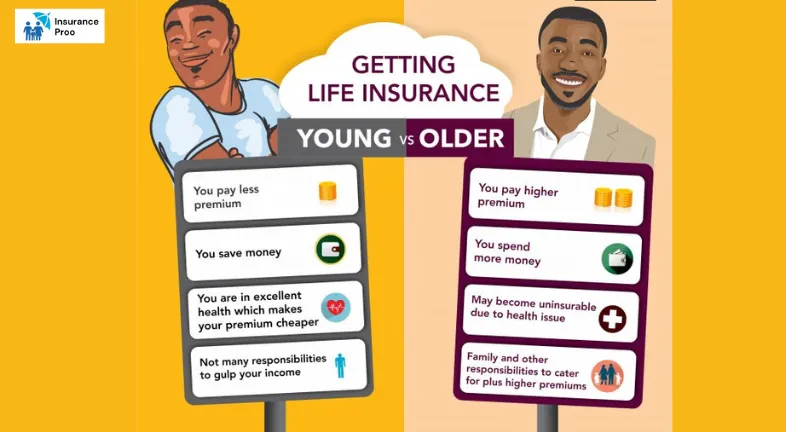

1. Lower Premiums

One of the most hypnotic reasons to purchase life insurance at a young age is the cost-effectiveness of premiums. These premiums are generally lower for younger individuals because they are perceived as lower risk by insurance companies. It means that locking in a policy at a young age can lead to essential savings over the life of the policy.

2. Guaranteed Insurability

When you buy insurance at a young age which you often have the option of guaranteed insurability. It means that you can secure coverage without undergoing additional medical examinations in the future, even if your health deteriorates. These features is particularly beneficial for young individuals who may develop health issues later in life.

3. Financial Security for Dependents

If you have offspring, For Instance, children or a spouse, then securing life insurance at a young age ensures that they will be financially protected in the event of your untimely death. The death benefits can cover living expenditures, education costs, and other financial obligations, which provides peace of mind for both you and your loved ones.

4. Building Cash Values

Many policies, for example, Whole Life or Universal Life Insurance which come with these cash value components. It means that portion of your premium payments multiply as cash value over time. Young policyholders can benefit from this feature since it allows them to build savings that can be accessed later in life for emergencies, loans, or retirement.

5. Longer Coverage Durations

Purchasing life insurance at a teenager’s age typically means that you can secure coverage for longer durations. It’s particularly important for those individuals who want to ensure that their loved ones are protected for an extended period, especially during critical life stages. For example. Raising children or paying off mortgages, too.

6. Peace of Mind at a Pace

Having life insurance provides peace of mind, knowing that your loved ones will be financially secure in the event of your passing. These emotional benefits are key as they allow you to focus on your career, family, and personal goals without the constant worry about financial consequences as well.

7. Potential for Future Insurability

Buying life insurance at a young age can also provide opportunities for future guarantees. Many policies offer riders that allow you to increase your coverage as your financial responsibilities grow. For Instance, getting married or having children. Flexibility may be crucial as life circumstances change.

8. Tax Benefits

These Life insurance death benefits aren’t generally subject to income taxes, which means that these beneficiaries will receive the full amount of the policy without tax deductions. Additionally, with these cash values, growth in permanent insurance policies is tax deferred, which leads to further financial advantages too.

9. Encouraging Financial

Purchasing life insurance at a young age can instill a sense of financial responsibility and awareness. It encourages individuals to think about their long-term financial goals, savings, and their importance of planning for the unforeseen.

10. Affordability of Additional Coverages

Young individuals often have fewer financial obligations, which makes it easier to afford additional coverage, too. As life progresses where financial responsibilities tend to increase while making it more challenging to secure adequate coverage without exceeding your budget.

What Is Life Insurance

“Life insurance” acts as a financial safety net for your family. If you die while it’s active, then your insurance company pays a sum of money to the people you’ve named in your policy. This money is known as the “death benefit,” which can help your beneficiaries replace your lost income and cover expenditures, For Instance, housing, food, and utility bills. Insurance may be used to pay for funeral expenditures, cover outstanding debts, or leave a legacy for loved ones or charitable organizations as well.

Key Takeaways

- “Life insurance” is a type of contract where you can make regular payments to an insurance company. In return, when you die, the company pays a sum of money to your chosen beneficiaries.

- Term life insurance, which offers affordable coverage for a specific period, like 10 or 20 years.

- Permanent life insurance, which provides lifelong protection with cash value components.

- Life insurance premiums are determined by factors, as the policyholder’s age, health, and lifestyle, with younger and healthier individuals paying lower rates. In teens in the U.S.teens present numerous benefits which including lower premiums, guaranteed insurability, financial security for dependents, and the potential for cash value accumulation. It offers peace of mind and encourages financial responsibility, which makes it a clever investment for young individuals. By securing coverage early that you can ensure that you and your loved ones are protected against unforeseen circumstances while paving the way for a more secure financial future.

By considering these, Premiums, Financial security, Dependents, Cash Value, Guaranteed insurability, Peace of mind, Tax Benefits, Financial responsibility, Coverage duration, young individuals can make informed decisions about their insurance needs which ultimately leads to greater financial stability (constancy) and security. I’m Glad if i Could Assist.

Final Conclusions or Verdict after the deeper analysis are as follows

In summary, buying this life insurance.[ is a contract between an insurer and the policy owner that guarantees a sum of money to the policy’s named beneficiaries when the insured dies. By considering these, insurance Premiums, Financial security, Dependents, Cash Value, guaranteed insurability, Peace of mind, Tax Benefits, Financial responsibility, Coverage duration, young individuals can make informed decisions about their insurance needs, which ultimately leads to greater financial stability (consistency) and security. I’m Glad if I Could assist.

Read more at: How to review your insurance policy annually