Best college student health insurance USA

When it comes to selecting the “Best Health Insurance for College Students in the USA “where several factors comes into play which includes when it comes to selecting the best health insurance for college students in the USA, several factors come into play which including coverage options, affordabilit,y and the specific needs of students. It’s a thorough guide that will explore the top health insurance options available for college students, highlighting key features, benefits, and considerations to help you make an informed decision.

Understanding College Student Health Insurance in detail as follows

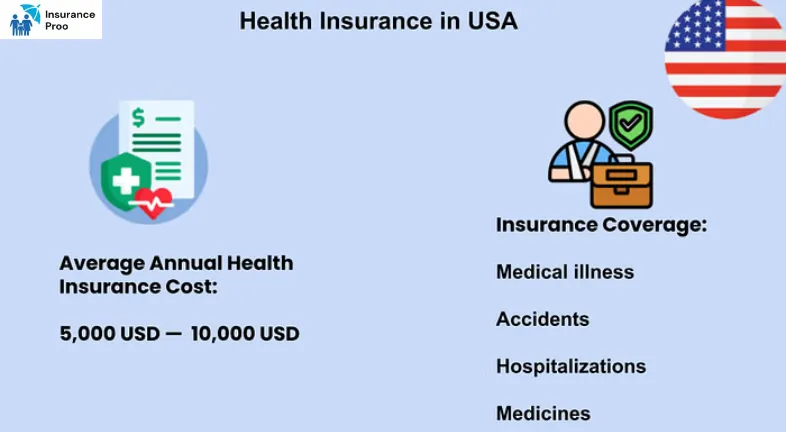

Health insurance is critical for college students since it provides access to necessary medical care, preventive services and also financial protection against unexpected health issues. Many colleges and universities offers their own health insurance plans, but students also have the option to purchase insurance from private providers or remain on their parents’ plans.

Key Factors to Consider are as follows

- Coverage Options:Just look for plans that covers wide range of services which includes routine check-ups, emergency care, mental health services and prescription medications.

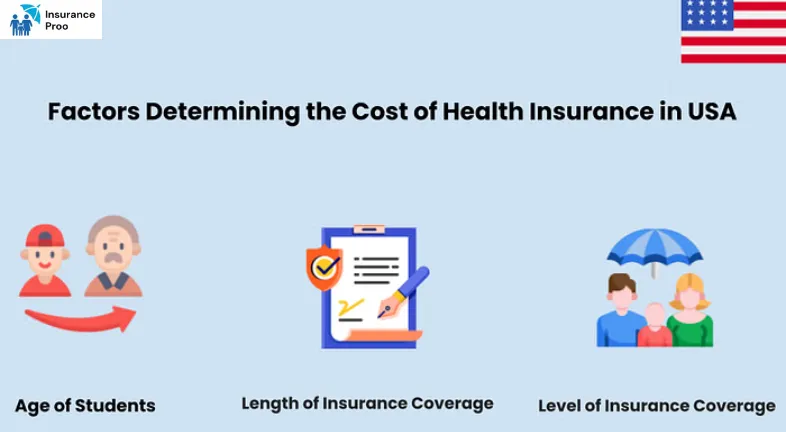

- Cost: Evaluate the premiums, deductibles and also out-of-pocket maximums. Some plans may have lower premiums but have higher deductibles which can affect overall costs.

- Network of Providers: Ensure that the plan has a vigorous network of healthcare providers, which includes doctors, specialists and hospitals near college campus.

- Preventive care: Many plans offer free preventive services ,likewise vaccinations and annual check-ups. It’s an essential feature for maintaining health while in college.

- Flexibility: Consider whether the plan allows for out-of-network care & also how that affects coverage and costs.

Top Health Insurance Options for College Students are as follows

- University-Sponsored Health Plans: Many colleges and universities offer their health insurance plans tailored for students. These plans often provide thorough coverage at competitive rates. Benefits typically include:

- Access to on-campus health services

- Coverage for mental health services

- Preventive care at no additional cost

- Before enrolling, check if your college requires students to have health insurance and whether they have instructions for enrollment in their plans.

- Marketplace Insurance Plans: The Health Insurance Marketplace is established under the Affordable Care Act (ACA), which offers a variety of health insurance plans. Students can apply for coverage during the open enrollment periods or qualify for a special enrollment period due to life changes, for eg. moving away from home. Key features include:

- A Range of plan options (Bronze, Silver, Gold, Platinum)

- Potential Subsidies based on income

- Comprehensive coverage includes essential health benefits

- Medicaid: Medicaid is a state and federal program that provides health coverage to eligible low-income individuals which including college students. Eligibility varies by state, but many states have expanded Medicaid under the ACA. Benefits include:

- No or low premiums

- Thorough coverage, including hospital visits and preventive care

- Access to a wide network of providers

- Short-Term Health Insurance: Short-term health insurance plans can be a temporary solution for students who need coverage for a limited time, likewise during a gap year or summer break. While these plans are generally more affordable while they often provide limited coverage and may not cover pre-existing conditions. Considerations include:

- Lower premiums compared to Traditional Plans

- Limited benefits and Coverage duration

- Not compliant with ACA Requirements

- Catastrophic Health Insurance: Catastrophic plans are designed for Young, Healthy Individuals who want to protect themselves against significant medical expenditures. These plans typically have low premiums but high deductibles. They cover essential health benefits after the deductible is met. Key points include

- Lower Monthly Premiums

- High Out-of-Pocket Costs until the deductible is reached

- Coverage for essential health benefits after the deductible

Popular Health Insurance Providers for College Students are as follows

- UnitedHealthcare: UnitedHealthcare offers a variety of health insurance plans for students, which include university-sponsored plans and individual marketplace options. Their plans often include:

- Comprehensive Coverage

- Access to a large network of providers

- 24/7 Virtual Care Options

- Blue Cross Blue Shield: Blue Cross Blue Shield (BCBS) is a well-known provider that offers health insurance plans across the country. Their student plans typically feature:

- Extensive Provider Networks

- Coverage for Preventive Services

- Options for International Students

- Aetna: Aetna provides health insurance plans specially designed for college students. Their offerings include:

- Flexible coverage options

- Access to wellness programs

- Mental health support services

- Kaiser Permanente: Kaiser Permanente is known for its integrated care model, which offers health insurance plans that include both coverage and access to healthcare services. Benefits include:

- Thorough coverage with a focus on preventive care

- Access to a network of healthcare providers

- Health management tools and resources

Tips for Choosing the Right Plans are as follows

- Assess Your Health Needs: Consider your medical history, any ongoing treatments and also expected healthcare needs while in college.

- Compare Plans: Use Online Comparison tools to evaluate different health insurance plans based on coverage, costs, and provider networks.

- Read Reviews: Look for Reviews and Testimonials from other students to measure the quality of care and customer service provided by different insurers.

- Consult with Advisors: Many colleges have health Insurance Advisors who can help students navigate their options and choose the best plan for their needs.

- Understand the Terms: Carefully read the policy documents to understand the coverage limits, bans, and any additional costs associated with the plans.

Final Conclusions or Verdict after the deeper analysis are as follows are mentioned below

Choosing the best Health Insurance for College Students in the USA requires careful consideration of various factors, which include coverage options, costs, and individual health needs. By exploring University-Sponsored plans, Marketplace Options, Medicaid, and Private Insurers where students can find plans that offer the right balance of affordability and Thorough coverage. Always remember to compare different options and consult with advisors to ensure you make an informed decision that supports your health and well-being during your college years.

Read more :- Health insurance for pre-existing conditions USA