Best Life Insurance Policies with cash value in the U.S.

When considering life insurance policies with cash value in the United States of America since it’s essential to understand the different types available, their benefits, nd how they can fit into your financial planning. Life insurance with cash values can serve as both a protective measure for your loved ones and a financial asset that grows over time. Here’s an overview of the best life insurance policies with cash value, along with key considerations and popular keywords related to these topics.

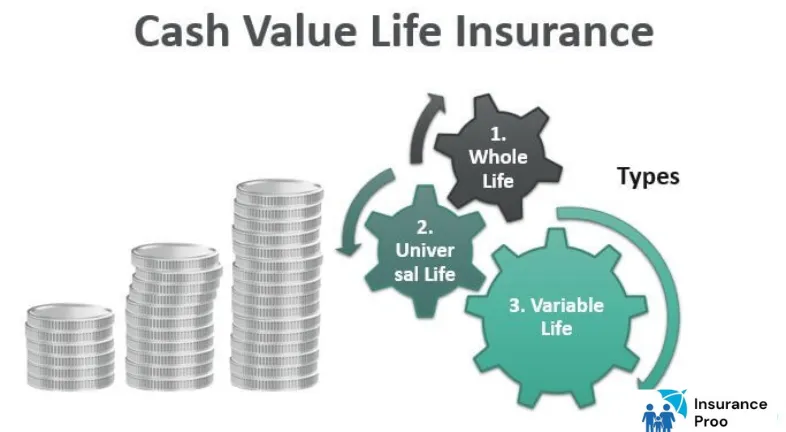

Types of Life Insurance with cash values

Whole Life Insurance

- Definition: Whole life insurance provides coverage for the insured’s entire life as long as premiums are paid. It’s inclusive of a cash values component that grows at guaranteed rates.

- Benefits: Guaranteed death benefit. Fixed premiums that do not increase over time. Cash value grows tax-deferred and can be borrowed against.

- Popular Providers: Companies like Northwestern Mutual, MassMutual, and New York Life are popular for their whole life policies.

Universal Life Insurance

- Definition: Universal life insurance, which offers flexible premiums and death benefits along with cash value components that earn interest based on market rates.

- Benefits: Flexibility in premium payments and death benefit amounts. Cash value can grow based on a credited interest rate. Option to adjust coverage as financial needs change.

- Popular Providers: Prudential, State Farm, and Transamerica offer competitive universal life policies.

Variable Life Insurance

- Definition: Variable life insurance allows policyholders to invest the cash value in various investment options, for eg, stocks and bonds, which can lead to higher returns but also carry more risk.

- Benefits: Potential for higher cash value growth based on investment performance. Flexible premiums & death benefits. Policyholders can choose how to allocate cash values among investment options.

- Popular Providers: Companies like MetLife, John Hancock, a nd Lincoln Financial Group provide variable life insurance policies.

Indexed Universal Life Insurance

- Definition: Indexed universal life insurance ties the cash value growth to stock market indexes which offers the potential for higher returns while providing a safety net against market losses.

- Benefits: Cash value growth linked to a stock market index (e.g., S&P 500). Downside protection with guaranteed minimum interest rates. Flexible premiums and death benefits.

- Popular Providers: Allianz, Nationwide, and Pacific Life are popular for their indexed universal life policies.

Key Considerations When Choosing a Policy are as follows

- Premiums: Understanding how Premiums are structured and whether they are fixed or flexible. Whole life policies typically have fixed premiums while universal and variable policies may offer more flexibility.

- Cash Value Growth: Evaluates how the cash value grows in each policy type. Whole life policies which offers guaranteed growth while universal and variable policies depend on interest rates and investment performances.

- Loan Options: Most policiesallows you to borrow against the cash values. Yet, unpaid loans will reduce the death benefit.

- Tax Implications: Cash value growth is tax-deferred and loans against the cash value are not taxed as income. Yet if the policy lapses or is surrendered where taxes may apply to the gains.

- Financial Strength of the Insurer: Choose reputable insurers with strong financial ratings to ensure they can meet their obligations.

Top Life Insurance Providers with Cash Value Policies are as follows

- Northwestern Mutual: It’s known for its strong financial ratings and customer service. Northwestern Mutual offers whole life insurance with competitive dividends and cash value growth.

- MassMutual: It offers whole life insurance with strong cash value components and the potential for dividends. They have a solid reputation for customer satisfaction as well.

- Prudential:It offers variety of life insurance products which includes universal and variable life insurance, with flexible options and competitive cash value growth.

- State Farm: It’s called for its universal life insurance policies since State Farm provides customizable options and strong customerservices.

- New York Life: It offers a range of whole life and universal life policies with strong cash value growth and the potential for dividends.

- Transamerica: It provides flexible universal life insurance options with competitive cash value growth and a variety of riders.

- Lincoln Financial Group: It’s known for its variable life insurance policies since Lincoln offers range of investment options for cash value growths.

- Allianz: It offers indexed universal life insurance with strong cash value growth potential linked to stock market indices.

Final Conclusions or Verdict after the deeper analysis are as follows are mentioned below

Selecting the best life insurance policy with cash values in the U.S. requires careful consideration of your financial goals, risk tolerance, and the specific features of each policy type. Whole life insurance provides stability and guaranteed growth, while universal and variable life insurance offer more flexibility and potential for higher returns. These Indexed universal life insurance policies strike a balance between growth potential and risk management.

When choosing Providers, consider their financial strength, customer service reputation and the specific terms of their policies. By understanding the different options available so that you can make an informed decision that aligns with your long-term financial strategy.

By focusing on aspects like Life insurance with cash value, Whole Life Insurance, Universal life insurance, Variable life insurance, Indexed universal life insurance, Cash value growth, Death benefit, Tax-deferred growth, Financial strength of insurers, P remiums flexibilit y, Life Insurance Provideto o ensure that you choose a life insurance policy that not only protects your loved ones but also serves as valuable financial assets [“Financial assets” are intangible instruments like stocks, bonds and bank deposits stoderive their value from contractual rights or ownership claims. Since they are typically more liquid than physical assets, which means they can be easily converted into cash. I’m happy to provide more information.

Read more at: Estate Planning with U.S. based Life Insurance