Estate Planning with U.S. based Life Insurance

Estate planning is a critical aspect of financial management that ensures your assets are distributed according to your wishes after your deaths. One of the most essential tools in estate planning is life insurance. In this article where we will explore how life insurance can play a vital role in estate planning, the types of life insurance available and also key considerations to keep in mind.

Understanding Estate Planning is as follows

Estate planning involves preparing for the transfer of your assets upon your death. In this process, which includes drafting wills, establishing trusts, and making decisions about supervision for minor children. The primary goal is to minimize taxes, avoid probate, and ensure that your loved ones are taken care of financially.

The Role of Life Insurance in Estate Planning is as follows

These life insurance policies can provide financial security for your beneficiaries and serve various purposes in estate planning:

- Income Replacement: Life insurance can replace lost income for dependents which ensuring they maintain their standard of living after your passing.

- Debt Coverage: It can cover outstanding debts, like as in mortgages, car loans and credit card balances which prevents your family from inheriting financial burdens.

- Estate Liquidity: These life insurance proceeds can provide liquidity to your estate, which allow your heirs to pay estate taxes and other expenditures without having to sell off assets.

- Wealth Transfer: It allows for a tax-efficient transfer of wealth to your beneficiaries, ass life insurance benefits are typically paid out tax-free.

- Charitable Giving: You can name a charity as a beneficiary after ensuring that a portion of your estate goes to a cause you care about.

Types of Life Insurance are as follows

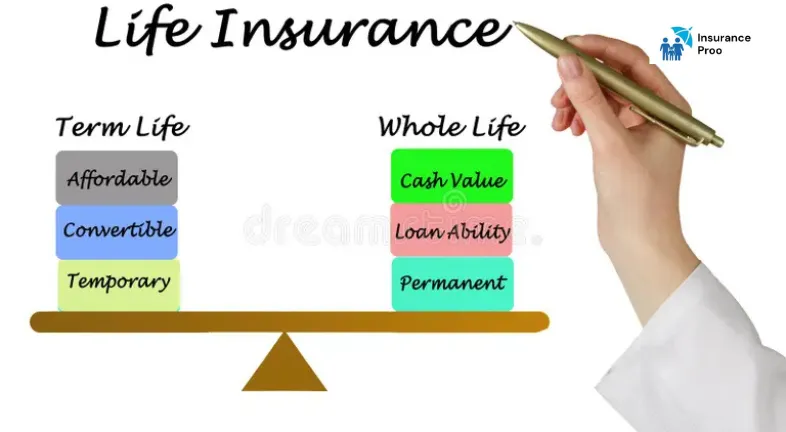

There are two primary types of life insurance commonly used in estate planning are as follows:

- Term Life Insurance: This type provides coverage for a specific period (e.g., 10, 20, or 30 years). It’s generally more affordable and is suitable for those who need coverage for a limited time, such as while raising children or paying off mortgages.

- Permanent Life Insurance: It includes whole life, universal life and variable life insurance. Permanent life insurance provides lifelong coverage and gathered cash value over time. This type of cash value can be borrowed against or withdrawn which provides additional financial flexibility.

Key Considerations in Using Life Insurance for Estate Planning are as follows

When incorporating life insurance into your estate plan then consider the following :

- Beneficiary Designations: It ensures that your life insurance policy has updated beneficiary designations. It will determine who receives the death benefit and can help avoid a transfer.

- Ownership of the Policy: The ownership of the policy can affect estate taxes as well. If you own the policy, then the death benefit may be included in your estate. Consider transferring this ownership to an irrevocable life insurance trust (ILIT) to keep the proceeds out of your taxable estate.

- Tax Implications: Let’s understand thèse tax implications of life insurance. While these death benefits are generally tax-free, any cash value growth may be subject to taxes if withdrawn.

- Reviewing Your Plan: Regularly review tyese estate plans and life insurance policies, especially after major life events For eg. marriage, divorce, or the birth of a child.

- Consulting Professionals: Working with these estate planning attorneys and financial advisors to create a thorough plan that meets your specific needs and goals.

Final Conclusions or Verdict after the deeper analysis are as follows are mentioned below

Incorporating the insurance into your estate planning strategy will provide peace of mind and financial security for your loved ones. Understanding these various types of life insurance and their roles in estate planning so that you can make informed decisions that align with your financial goals. Always remember to regularly review your estate plans and consult with professionals to ensure your wishes are honored and your beneficiaries are protected.

By utilizing these Estate Planning, Life Insurance, Financial Security, Wealth Transfer, Beneficiary Designations, Tax Implications, Term Life Insurance, Permanent Life Insurance, Estate Liquidity, Irrevocable Life Insurance [An “Irrevocable Life Insurance Trust” (ILIT) is a legal arrangement where an individual (the grantor) transfers his ownership of a life insurance policy to a trust, which then manages the policy and distributes the death benefit to designated beneficiaries. The key feature is that the trust’s terms, once established then cannot be changed or terminated by the grantor.

Here’s a more detailed breakdown as follows:

- Purpose: ILITs are primarily used for estate planning, particularly to reduce estate taxes and protect beneficiaries from financial mismanagement.

- Ownership: The grantor transfers the life insurance policy to the trust, which then owns and controls the policy.

- Irrevocable Nature: The trust cannot be changed or modified after it’s been established.

- Estate Tax Reduction: By owning the policy, the trust can keep the death benefit out of the grantor’s taxable estate then potentially reducing estate taxes.

- Beneficiary Protection: The trust can help ensure beneficiaries receives the death benefit as intended which preventing waste or misuse.

- Creditor Protection: The trust can shield the death benefit from creditors of the grantor or beneficiaries.

Example

A father, John which creates an ILIT to own a life insurance policy. He names his children as beneficiaries. Upon his death, the trust manages the policy proceeds, and the children receive the death benefit, which potentially minimizes estate taxes and ensures responsible financial management.] Trust (ILIT) effectively throughout your estate planning discussions where one can enhance your understanding and communication regarding the importance of life insurance in protecting your inheritance and providing for your loved ones. I trust this will be helpful.