Health insurance for pre-existing conditions USA

“Health Insurance” for initial conditions is a point of view topic that affects millions of individuals seeking coverage. Understanding how health insurance companies handle these previous conditions can help consumers make informed decisions about their healthcare options. This article will explore the definition of pre-existing conditions, the impact of the Affordable Care Act (ACA), the types of health insurance available, and tips for obtaining coverage.

Definition of Pre-existing Conditions is as follows

A previous condition is any health issue that existed before an individual’s health insurance policy was initiated. Common examples which includes diabetes, asthma, cancer, heart disease and also mental health disorders. Historically where insurance companies could contradictory coverage or charge higher premiums which are based on these conditions, leading to significant barriers for individuals who needs care.

The Impact of the Affordable Care Act is as follows

The Affordable Care Act (ACA), which was enacted in 2010, also transformed the terrain of health insurance in the United States. One of its most significant provisions was the prohibition of denying coverage based on pre-existing conditions. It means that insurance companies cannot refuse to cover individuals or charge them higher premiums due to their health history. The ACA also established essential health benefits that must be covered by all plans while ensuring that individuals with pre-existing conditions can have access to necessary care.

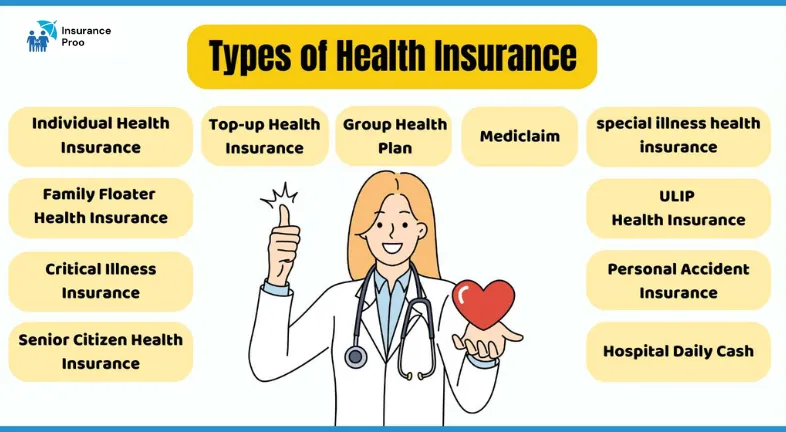

Types of Health Insurance available are as follows

- Employer sponsored Insurance: Many individuals which receive health insurance through their employers. Under the ACA where employers cannot deny coverage based on pre-existing conditions which makes it a useful option for many.

- Individual Health Insurance Plans: For those not covered by employer-sponsored insurance, where individual health plans are available through the Health Insurance Marketplace. It covers individuals, their spouses, children, and also parents, according to Study.com.These plans must comply with ACA regulations, which include coverage for pre-existing conditions.

- Family Floater Health Insurance: It provides coverage for the entire family and is often more affordable than individual plans, according to Study.com.

- Senior Citizens Health Insurance: It is specifically designed for individuals over 60, offering coverage for a range of medical needs.

- Group Health Insurance: It’s offered by employers to their employees since according to HDFC Life Insurance.

- Medicaid: These Medicaid provides coverage for low-income individuals and also families. Many states expanded Medicaid under the ACA which allows more people with pre existing conditions to qualify for coverages.

- Medicare: Individuals aged 65 and older, or those with certain disabilities, may qualify for Medicare. These Pre-existing conditions do not affect eligibility for Medicare, although there may be waiting periods for certain benefits.

Concept of Health Insurance

“Health insurance” is a contract where an insurance company agrees to cover the cost of medical care in exchange for regular premiums paid by the policyholder. It does provide financial protection against unexpected healthcare expenditures due to illness, injury, or accident. Here’s a more detailed look at the concept:

- Contractual Agreement: A Health insurance policy is a contract between the policyholder and the insurance company, outlining the terms and conditions of coverage.

- Financial Protection: It helps reduce the financial burden of healthcare costs that ensures entry to necessary medical treatments and preventing financial issues.

- Premium Payment: Policyholders pay a premium (usually monthly) to maintain their coverage.

- Coverage: Health insurance policies which covers range of medical services which are inclusive of hospital stays, doctor visits, preventive care, and also prescription medications since according to Star Health Insurance.

- Cashless or Compensation: Insurance companies may either directly pay for medical expenditures (cashless treatment) or compensate the policyholder for covered costs.

The importance of Health Insurance is as follows

- Access to Healthcare: It helps individuals approach necessary medical care even when facing high costs.

- Financial Stability: It protects individuals from the financial pressure of unexpected healthcare expenditures.

- Preventive Care: Some health insurance plans that offer coverage for preventive care & also promote overall well-being.

- Emergency Situations: It provides financial support during medical emergencies while reducing the burden on individuals.

Tips for Obtaining Coverage are as follows

- Understand your Rights: Just familiarize yourself with the protections offered under the ACA.After knowing your rights can authorise you to seek coverage without fear of discrimination which is based on your health history.

- Explore the Health Insurance Marketplace: During open enrollment periods where individuals can shop for plans that fit their needs. These Marketplace which allows you to compare different plans and also find one that covers your pre-existing conditions.

- Consider Short Term Health Insurance: While it’s not a long-term solution yet short-term health insurance can provide temporary coverages. However these plans may not cover pre-existing conditions so they should be approached with caution.

- Seek Professional Assistance: Negotiating health insurance options which can be complex.Just Consider consulting with a licensed insurance agent or a healthcare navigator who can help you understand your options and also find the best plan for your needs.

- Review Plan Details carefully: When selecting a health insurance plan, review the details regarding coverage for pre-existing conditions. Just ensure that the plan covers necessary treatments and also includes medications related to your conditions.

Final Conclusions or Verdict after the deeper analysis are as follows

These Health insurance policies for pre-existing conditions have undergone significant changes where particularly with the implementation of the Affordable Care Act. Individuals seeking coverage that can no longer be denied based on their health history, which allows for greater access to necessary healthcare services. By understanding the types of insurance available and knowing their rights where individuals can guide the health insurance landscape more effectively. Whether through employer-sponsored plans, the Health Insurance Marketplace, Medicaid, or Medicare as there are many options available to ensure that those with earlier conditions receive the care they need. Is this what you were looking for?

Read more :- How to file an insurance claim in the U.S