Insurance Fraud and Digital Identity Verification

Insurance fraud is a problem that affects everyone in the world and is the main cause of monetary losses estimated at billions of dollars. Fictitious claims not only concern insurance organizations but also all stakeholders including the bona fide policyholders. The detection and deterrence of insurance fraud by insurance firms is even more difficult whenever changes in technology occur because criminals also familiarize themselves with the new technology. Nevertheless, the present age of technology provides a justifiable manner in the combating of unlawful behaviors courtesy of the development of digital identity authentication.

This blog will present the advantages that electronic verification of identity has in dealing with fraud and its effects on insurance and discuss the relationship between the rampant insurance problem and the use of digital verification in establishing identity.

Understanding Insurance Fraud

Insurance fraud refers to the act of undermining an insurance system and encompasses activities committed by both policyholders and people outside. It may e.g. assuage itself with bogus allegations and distortion of facts. Assured fraud exists for all forms of assurance cover which involves health, life, motor, property, and workman compensation assurance.

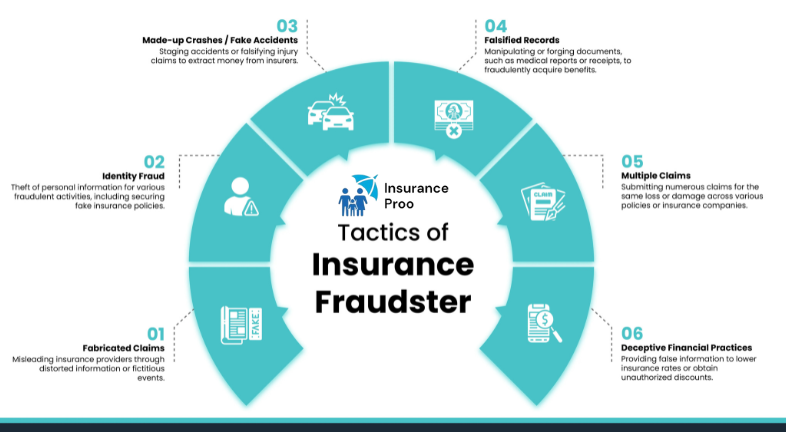

Types of Insurance Fraud

- Hard Fraud:This is a form of fraud purposely and knowingly executed where an individual invents an incident, damage, injury, or any amount that may be claimed. For instance, set your car on fire for an insurance claim or suffer a workplace injury from slipping on wet flooring.

- Soft Fraud: As a rule, this phenomenon is referred to as opportunistic fraud and it is typified by a legitimate claim that is too excessive. For instance, in a bid to receive a higher payment, an individual may exaggerate the level of injuries or damage suffered in an insignificant auto collision.

- External Fraud: This means that it may be possible that the fraud welder in question is not even a policyholder because it was produced by third parties. This also includes an element of identity theft, in which a person uses a dead person’s name and creates fake insurance policies or claims using their information.

- Internal Fraud: This is dealt by people who work in the insurance domain. Employees might provide false information or make claims that are not true for their own benefit.

The Cost of Insurance Fraud

One of the major issues that is draining the resources of the country and raising the premiums of genuine policy holders is insurance fraud. The FBI estimates that the annual cost of insurance fraud – excluding that of health insurance – to the United States is about 40 billion dollars. Consequently, the insurance costs for an average American household go up by between 400 and 700 dollars per year.

Everywhere across the globe, the problem of insurance fraud is growing and with the advancement of technology, more schemes are being developed. Bogus claims do not only drain the finances of insurance companies but also make them lose out on goodwill which in turn affects the consumers.

The Role of Digital Identity Verification in Preventing Fraud

Incorporating digital identity authentication has changed the way organizations approach managing trust and the risk of fraudulent behavior. This is where identity verification comes into play, ensuring that the person making a claim or an insurance application is indeed the person they profess to be. While these systems were previously relatively easy to defeat by fraudsters, the advent of modern technologies like the bloc chaim, biometric and AI based systems has made the fraudster’s work quite difficult.

What is Digital Identity Verification?

Cyber identities are the means of establishing one’s degree of trustworthiness and identity using digital tools. This may include any number of approaches, including the:

- Biometric Verification: It encompasses the various techniques used to ascertain the identity of a person, such as voice recognition, fingerprinting, or facial recognition.

- Document Verification: This involves capturing, reviewing, and authenticating government-issued identity cards which may include passports, national identity cards, and driving licenses.

- Knowledge-Based Authentication (KBA): For particular questions, only the subject of the verification should be the source of information.

- Behavioral Biometrics: Keeping track of the advancement of the interactions between the individual and the device by assessing the movement of the mouse, the keystroke rate, and the use of a phone.

- Two-Factor Authentication (2FA): requiring two forms of identification, such as a password and a one-time code that is sent to a mobile phone.

Insurance companies can greatly manage the exposure to risks of fraud by ensuring that in important milestones for the customer such as making a purchase, altering a policy or presenting a claim, the identity of the client is ascertained.

The Future of Digital Identity Verification in Insurance

The trends that will change the prevention of insurance fraud and its future direction will relate more to the improvements in digital verification of one’s identity. The instruments of identification will also evolve since technology progresses, for example through the use of artificial intelligence, machine learning or blockchain technology.

Advanced algorithms created from artificial intelligence can be used to analyze wide data sets, detect suspicious behaviors and help insurance companies to beat fraud before it starts.

In addition, multi-layered verification approaches that combine several methods—such as biometric checks, document verification, and behavioral biometrics—will become the norm, offering insurers a comprehensive and reliable way to verify identities and detect fraud.

Conclusion

Although an ongoing problem, digital identity verification is a powerful weapon against insurance fraud. Modern technologies including blockchain, biometrics and artificial intelligence enable insurers to not only prevent fraud, but also improve customer experience and ensure compliance.

As business grows, absolutely reducing fraud and maintaining trust between insurers and policyholders depends on the adoption of digital identity verification. Staying ahead with innovative verification techniques is essential in a world where fraud is becoming increasingly sophisticated.