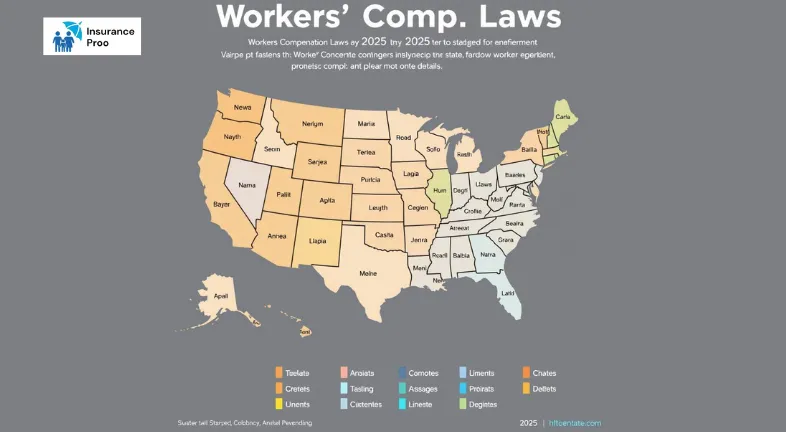

Workers' Compensation Insurance Requirements by State 2025

Workers’ compensation insurance is a key component of employee protection in the United States of America, which provides benefits to workers who suffer job-related injuries or illnesses. The requirements for workers’ comp insurance may vary significantly by state, reflecting local laws, regulations, and industry practices. As of 2025 where understanding these requirements is essential for employers to ensure consent and to protect their employees. This article will explore the workers’ comp insurance requirements by state, highlighting key aspects and frequently used keywords.

Overview of Workers' Compensation Insurance is as mentioned below

These Workers’ compensation insurance are designed to cover medical expenditures, recovery costs, and lost wages for employees injured on the Jobs. In exchange for these benefits, employees typically vacate their right to sue their employer for negligence. The specific requirements for workers’ comp insurance which are inclusive of coverage limits, exemptions and filing procedures which differs from states to states.

General Requirements are as follows

Most of these states require employers to carry workers’ compensation insurance if they have a certain number of employees, which often ranges from one to five. However, some states have exemptions for specific industries or types of workers, likewise sole proprietors, independent contractors, or agricultural workers. Employers must also act in accordance with state-specific reporting and filing requirements to maintain their coverages.

State-by-State Breakdown is as follows

- California

California requires the most employers in order to carry workers’ compensation insurance just regardless of the number of employees. These statez has highly regulated system with specific benefits and coverage limits. Employers can purchase insurances from private carriers or the state-run funds . - Texas

Texas is unique in that it does not mandate workers’ compensation insurance. Yet employers who opt out of coverage must inform their employees and may face increased liability in the event of workplace injuries as well. - New York

In New York, all of these employers must provide workers’ compensation insurance for their employees. The state has strict penalties for non-compliance, which are inclusive of fines and potential criminal charges. - Florida

Florida requires workers’ compensation insurance for employers with four or more employees in most industries. Construction companies should carry coverage if they have one or more employees. - Illinois

Illinois requires workers’ compensation insurance for all employers with at least one employee. The state has no faulty systems, defining employees do not need to prove negligence to receive benefits for the same. - Ohio

In Ohio, workers’ compensation which provided through a state-run fund, and all employers are required to participate. Employers can choose to self-insure, but they should meet specific criteria.

- Pennsylvania

Pennsylvania requires all employers to carry workers’ compensation insurance. The state has competitive markets that allow employers to choose from various private insurers. - Michigan

In Michigan, employers must provide workers’ compensation coverage ‘workers Compensation insurance, which provides financial support to employees who suffer work-related injuries or illnesses, is inclusive of medical expenditures, lost wages, and rehabilitation costs. It’s a form of insurance which are typically purchased by employers to fulfill legal requirements and protect their workforce. In India, the Workmen’s Compensation Act of 1923 mandates this coverage for employees. - Georgia

Georgia ordered workers’ compensation insurance for employers with three or more employees. The state also allows for self-insurance with proper approvals. - Washington

Washington has a state-run workers’ compensation system, and all employers must participate. The state does not allow private insurance options, which makes it unique in its approaches.

Here's a more detailed look at workers' compensation coverage as follows

Key Features are as follows:-

- Medical Expenditures: It Covers the cost of Medical treatments, which are inclusive of hospital bills, doctor visits, and therapy.

Lost Wages: It provides financial support to employees who are unable to work due to a workplace injury or illness.

Rehabilitation: It may cover recovery services like physical therapy or vocational training to help employees return to work.

Death Benefits: It provides financial support to the family of an employee who dies due to a work-related injury or illness.

Legal Protection: It protects employers from lawsuits by injured employees.

Who is Covered???

- Employees: Workers’ compensation typically covers employees, but not necessarily independent contractors or freelancers.

- Occupational Illnesses: Its coverage extends to illnesses that are a result of work conditions, not just accidents.

- Temporary and Permanent Disabilities: The policy provides support for both temporary and permanent disabilities resulting from workplace injuries.

How it Works

- Employers Purchase Insurance: Employers can purchase workers’ compensation policy from an insurance company.

- Claims Filing: When an employee is injured or becomes ill due to a workplace incident, they file a claim with the insurance company.

Benefits Paid: The insurance company may review the claim and, if approved, then pay the employee’s medical expenditures and lost wages.

Rehabilitation and Return to Work: The insurance company may also help with recovery and may find alternative work opportunities for employees who are unable to return to their original jobs. For employees. The state has unique systems that include both insurance and self-insurance options.

Key Considerations are as follows

- Coverage Limits: Each of these states sets its coverage limits and benefits. Employers must amiliarize themselves with these limits to ensure adequate protection for their employees.

Exemptions: Some of these states allow exemptions for certain types of workers or industries. Employers should verify whether they qualify for any exemptions to avoid unnecessary costs.

Penalties for Non-Compliance: States should impose various penalties for failing to carry workers’ compensation insurance, which include fines, legal action, and increased liability in workplace injury cases.

Claims Process: Understanding the claims process is pivotal for both employers and employees. Each state has specific procedures for reporting injuries and filing claims, which should be followed to ensure timely benefits.

Final Verdict after the above discussion in detail is as follows

Navigating the workers’ compensation insurance requirements by state is essential for employers to ensure compliance and protect their employees. As of 2025, after understanding the variations of each state’s regulations, coverage limits, and exemptions, which are critical for maintaining a safe and legally flexible workplace. By staying informed and proactive where employers can effectively manage their workers’ comp insurance needs and safeguard their workforce against job-related injuries and illnesses. I Hope This Helps you Move Forward.

Read more at : Affordable family health insurance plans USA 2025